Tax Benefit of Operating Leases vs Capital Leases

What Is a BOC3 Filing for Transportation Companies

August 1, 2022Best Accounting Software for Medium-size Business in 2024

August 5, 2022

Expenses generally paid by a buyer to research the title of real property. You can use Schedule LEP (Form 1040), Request for Change in Language Preference, to state a preference to receive notices, letters, or other written communications from the IRS in an alternative language. You may not immediately receive written communications in the requested language.

How to Choose the Right Calculation Method for Your Business

The placed in service date for your property is the date the property is ready and available for a specific use. If you converted property held for personal use to use in a trade or business or for the production of income, treat the property as being placed in service on the conversion date. See Placed in Service under When Does Depreciation Begin and End?

Leasing vs. Purchasing: Depreciation & Tax Implications

Treat the carryover basis and excess basis, if any, for the acquired property as if placed in service the later of the date you acquired it or the time of the disposition of the exchanged or involuntarily converted property. The depreciable basis of the new property is the adjusted basis of the exchanged or involuntarily converted property plus any additional amount you paid for it. The election, if made, applies to both the acquired property and the exchanged or involuntarily converted property. This election does not affect the amount of gain or loss recognized on the exchange or involuntary conversion. Instead of using the rates in the percentage tables to figure your depreciation deduction, you can figure it yourself.

- ASC 842 is a game-changer in how leases are handled on financial statements.

- A partner must reduce the basis of their partnership interest by the total amount of section 179 expenses allocated from the partnership even if the partner cannot currently deduct the total amount.

- If you placed your property in service in 2023, complete Part III of Form 4562 to report depreciation using MACRS.

- This entry spreads the cost of the right-of-use asset over its useful life.

- The following table shows the declining balance rate for each property class and the first year for which the straight line method gives an equal or greater deduction.

Useful Items

For more information, refer to Publication 946, How to Depreciate Property. For certain qualified property acquired after September 27, 2017, and placed in service after December 31, 2022, and before January 1, 2024, you can elect to take a special depreciation allowance of 80%. This allowance is taken after any allowable Section 179 deduction and before any other depreciation is allowed. If none of these conditions are met, then the lease must be classified as an operating lease. Your company’s rental inventory includes any items it rents out to customers, from DVDs to steam shovels to tuxedos.

Depreciation for Operating Leases

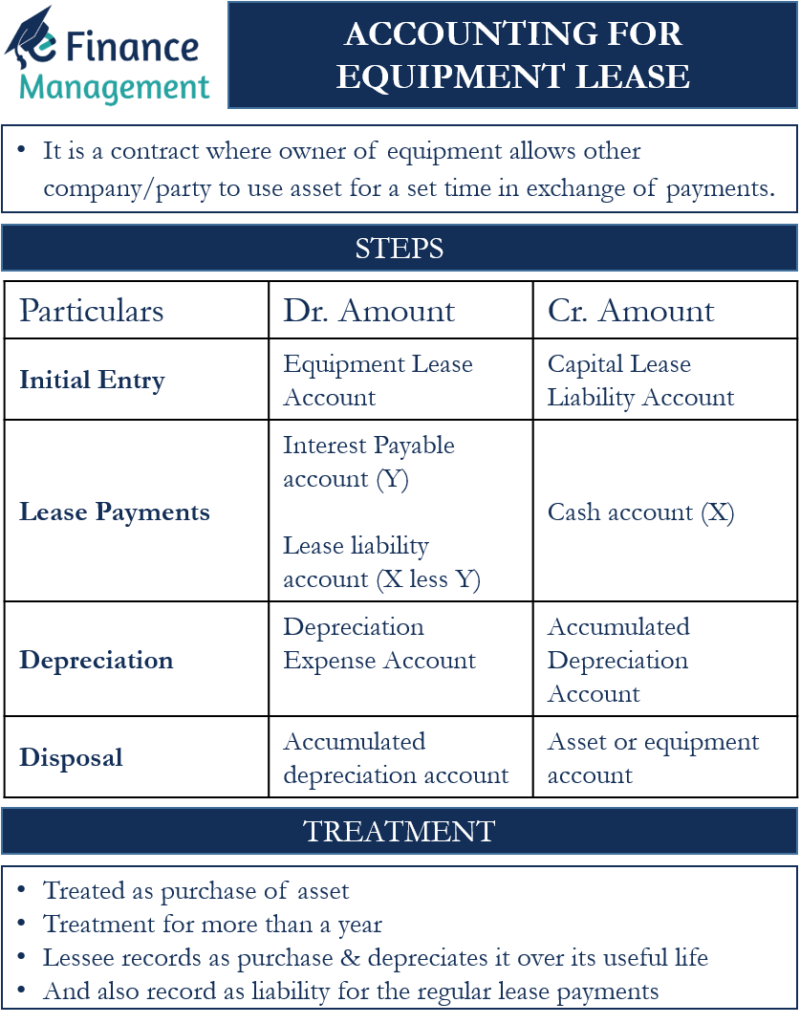

Next, we will look at specific journal entries for leased equipment to make this process even clearer. The amounts for both entries will be the present value of the lease payments you are obligated to make over the lease term. Whether the agreement is a lease or a conditional sales contract depends on the intent of the parties as evidenced by their agreement, which is read in light of the facts and circumstances when it was entered into. Determine the parties’ intent based on the facts and circumstances that exist when you enter into the agreement.

Overview of Depreciation

Go to IRS.gov/SocialMedia to see the various social media tools the IRS uses to share the latest information on tax changes, scam alerts, initiatives, products, and services. Don’t post your social security number (SSN) or other confidential information on social media sites. Always protect your identity when using any social networking site. On IRS.gov, you can get up-to-date information on current events and changes in tax law..

The numerator of the fraction is the number of months (including parts of months) the property is treated as in service in the tax year (applying the applicable convention). If there is more than one recovery year in the tax year, you add together the depreciation for each recovery year. Instead of using the above rules, you can elect, for depreciation purposes, to treat the adjusted basis of the exchanged or involuntarily converted property as if disposed of at the time of the exchange or involuntary conversion.

For this purpose, the adjusted depreciable basis of a GAA is the unadjusted depreciable basis of the GAA minus any depreciation allowed or allowable for the GAA. To determine the midpoint of a quarter for a short tax year of other than 4 or 8 full calendar months, complete the following steps. Under the mid-month convention, you always treat your can you depreciate leased equipment property as placed in service or disposed of on the midpoint of the month it is placed in service or disposed of. The first quarter in a year begins on the first day of the tax year. The second quarter begins on the first day of the fourth month of the tax year. The third quarter begins on the first day of the seventh month of the tax year.

The land improvements have a 20-year class life and a 15-year recovery period for GDS. During the year, you made substantial improvements to the land on which your paper plant is located. You then check Table B-2 and find your activity, paper manufacturing, under asset class 26.1, Manufacture of Pulp and Paper. You use the recovery period under this asset class because it specifically includes land improvements.